Is the California housing market about to crash anytime soon? How will real estate investors and homeowners be affected? Is it still a good idea to invest money in real estate? These are questions that have virtually been on every homeowner and real estate investor’s mind because of the economic downturn and record-high inflation in the United States. Given what the real estate market has experienced over the last few years, these are valid concerns.

Home affordability in California went from bad to worse when property values and home prices skyrocketed at a historically high rate in 2021. This trend continued to spiral downward due to rising mortgage interest rates, which made it even more difficult to afford a property.

In order to combat inflation, the Federal Reserve raised the federal funds rate seven times in 2022 alone, ending the days of record-low mortgage rates. The upward trend of interest rates added much-needed downward pressure on the California housing market as property sales declined drastically while many hopeful buyers wait on the sidelines for property values to crash.

Aside from high interest rates, other factors such as ongoing economic uncertainty and the widespread doom-and-gloom narrative on the internet and television have pushed many homeowners, property owners, real estate investors, and people looking to buy a home into a state of fear and confusion.

Even though various experts are split on whether the California real estate market will crash or not, there’s no denying that the US economy is experiencing uncertainty due to the lingering effects of the COVID-19 pandemic and unfortunate events affecting the global economy. However, it is also common knowledge amongst wealthy investors that real wealth is built, and more millionaires are made during economic downturns because of the abundance of opportunities available during these periods for those who are willing to take advantage of them.

So how can you navigate through this period and take advantage of today’s real estate landscape to build your wealth?

As an experienced real estate investor and broker in Long Beach, California, I have access to a network of experienced investors who have accomplished what everyone aims to achieve in real estate: become financially independent, generate passive income, and build generational wealth. They are the type of seasoned real estate investors that have thrived through more than one recession and are still active in today’s market.

In order to fulfill our mission of giving you the right information to make the right investing decisions and help you build wealth through real estate, I spoke with several investors to see how they’re navigating today’s new real estate market. In this article, I’m going to share with you all of the advice and information I learned from speaking with them so you can make better real estate investment decisions in 2023 and beyond.

Are real estate investors still looking to buy properties in today’s market?

You might think that because most buyers are sitting on the sidelines waiting for property values to drop, experienced real estate investors are also waiting for huge discounts on investment properties. This can’t be any further from the truth. All of the investors that I spoke with and interviewed are still in the market vigorously searching for the right real estate deals.

What defines the right property deal in today’s market?

One thing you need to know about finding the “right deal” is that everyone has a unique opinion on what it means. At the end of the day, the right deal might be different for you than it is for me. Of course, every investor wants to find a deal with a good rate of return, capitalization rate, or growth potential, but sometimes the right deal depends on what’s more important to you. It could be the financials, the location, or even the amenities of the property you’re looking for.

Regardless of what you hold important in a real estate deal, here’s the approach that experienced investors are taking when it comes to finding the right property deal:

“We’ll hold on to our properties as long as we can. We’re still looking for good deals, but we won’t take any action unless there’s a deal that we absolutely want.”

Market Factors that Influence the Decisions of Real Estate Investors

There are multiple factors and pieces of information that will influence your decision-making to give you the idea of whether a specific property is a good deal or not. Is it a good time to buy a property? Should you hold off on selling your property or sell it before its value goes up or down? When it comes to knowing how to navigate any real estate market, experienced investors typically look at three simple factors when considering these questions:

Property Prices

Whether you’re someone looking to buy a property or you already own one, the fluctuation of property values holds a lot of influence on anyone’s ability to decide to take action. If property values do indeed drop, then you’ll get a good discount as a buyer. However, it’s not a positive for sellers in the market.

Although major financial institutions still have mixed opinions on the future trajectory of the real estate market, all of the investors I interviewed believe that California multifamily property values will not crash but will still experience a slight price reduction in 2023.

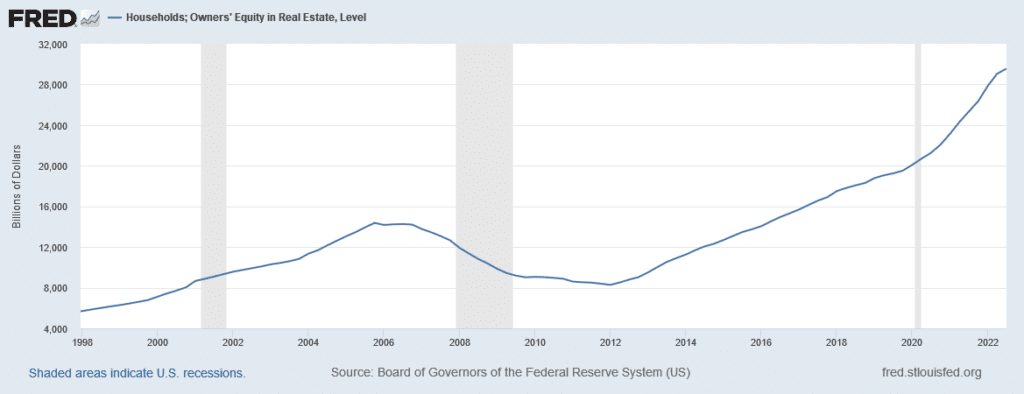

There will never be a wave of foreclosures like what happened in 2008, and there will never be an influx of highly-discounted properties coming to the market in 2023 because existing property owners generally have a substantial amount of equity in their homes.

However, California real estate properties will experience a slight price reduction due to these two other factors: interest rates and inventory. It’s all about a simple economic principle called supply and demand. If the supply of properties is higher than buyer demand, then property prices will go down. If buyer demand is significantly higher than the available supply, then property prices will soar just like how they did in 2021.

Mortgage Interest Rates

The number one factor that influences buyer demand is interest rates. The lower the interest rate a buyer can get, the more affordable their mortgage is going to be.

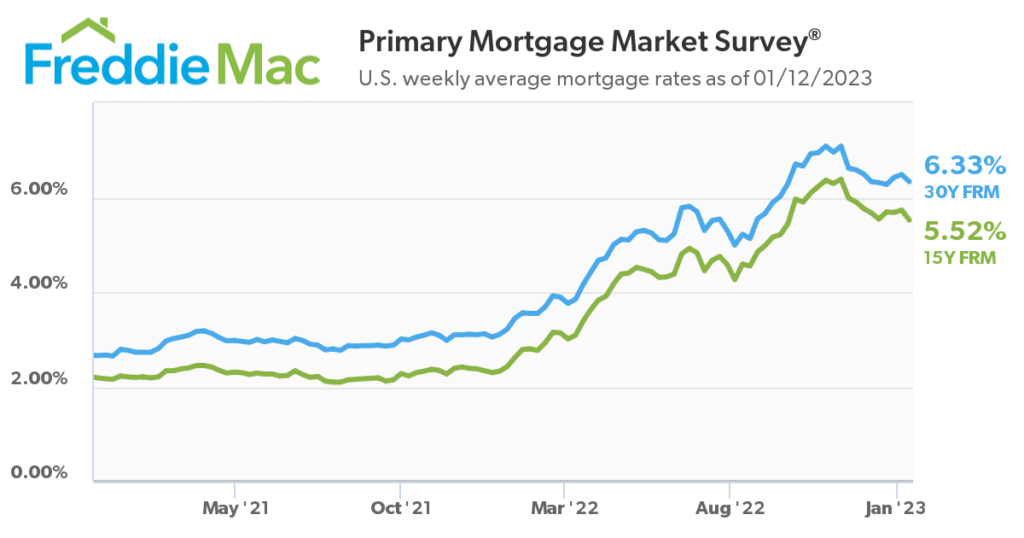

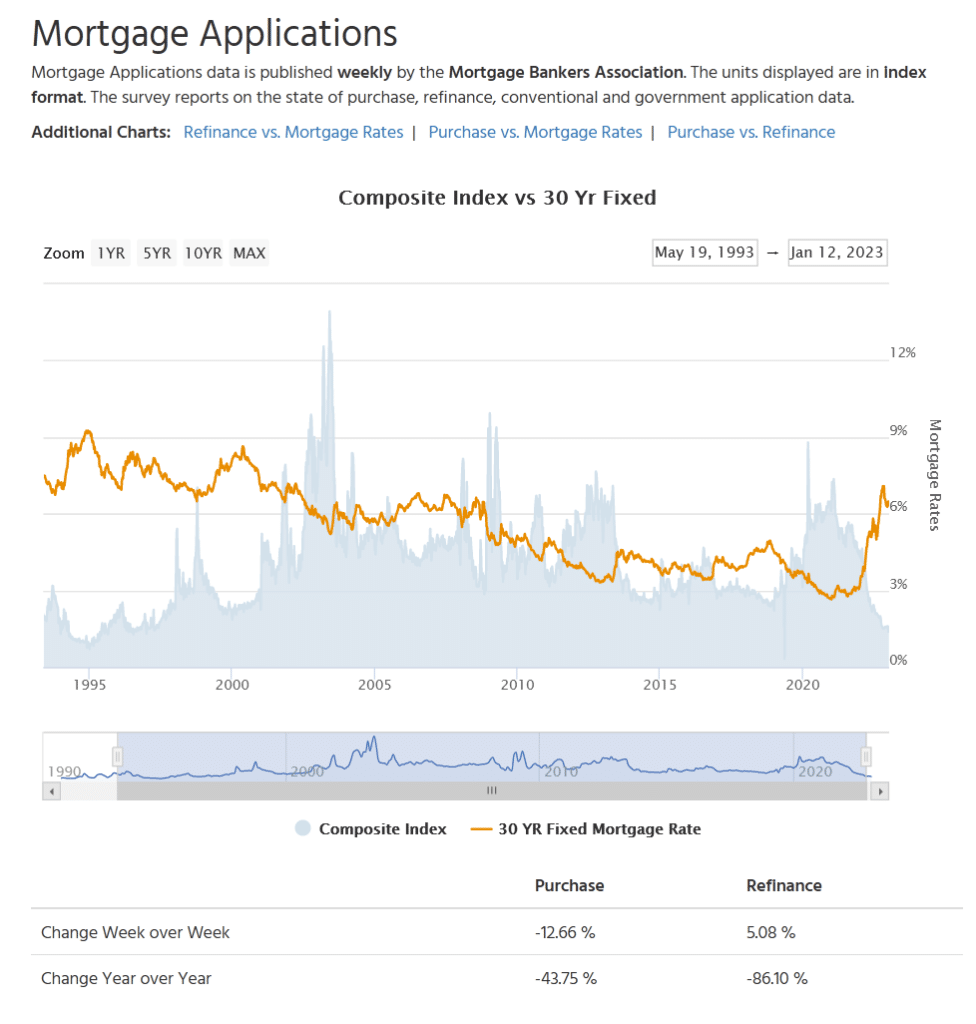

In 2022, a 30-year fixed rate rose from as low as 3.22% in January to as high as 7.08% in November. This huge jump in mortgage interest rates substantially reduced the demand for housing so much that mortgage applications for purchasing properties decreased by almost 44% and applications for refinancing dropped by over 86% since 2021, the lowest level of demand we’ve seen in almost three decades.

All experienced investors are still expecting the Federal Reserve to increase interest rates one or two more times in 2023 before they start going down. This will further reduce buyer demand, and add more downward pressure to property values.

Regardless of whether the Federal Reserve decides to increase interest rates or not, it is important to accept the fact that any interest rate around 6% is the new normal in today’s real estate market.

The historically-low rates at around 3% which every buyer got used to were only available for a temporary period of time, and probably won’t be that low for a while. Compared to the average rate of 7.54% in 1971, 18.45% in 1981, or even 10.13% in 1990, today’s “new normal” interest rate at around 6% doesn’t sound as bad as everyone thinks it is.

Market Inventory

Market inventory basically measures the number of properties listed for sale on the market. Most experienced real estate investors are optimistic and believe that there will be more properties available for sale in the market during 2023.

The first reason is that there will be more motivated sellers in the market willing to sell their properties despite price reductions. Since properties have mostly stopped appreciating in value, more and more owners are considering selling their properties because of the general fear of a market crash. If property values indeed drop significantly, then it might be a good idea for any owner to sell an existing property to protect the equity it has appreciated over the years.

Financing a Multifamily Property in 2023 (2 to 4 Units)

Buying a multifamily property in 2023 is not how it used to be in 2022 or even 2021. The market has changed as well as buyers and sellers. If you’re still considering purchasing a multifamily property with a mortgage loan or some sort of financing, here’s what you need to know:

It is still possible to finance a multifamily property with a 25% downpayment on your mortgage, but the numbers won’t be balanced in terms of a cash flow perspective. Most investors would usually think that a 20-25% downpayment would be enough to secure a loan on a property. While that is certainly possible, today’s higher interest rates are pushing buyers towards higher monthly mortgage payments. The higher expense of owning a property today might leave investors having to deal with negative cash flow for at least the first year of ownership.

Whenever you buy a duplex, triplex, or fourplex in California, the first 12-18 months of ownership are going to be cash flow negative for most real estate investors. Since multifamily property prices are still high and have not adjusted to higher interest rates compared to single-family residential properties, the financial aspect of any property deal does not look favorable today compared to the early days of 2022.

Knowing that multifamily properties don’t typically cash flow positively during the first 12-18 months of ownership, it’s still a good time to purchase a property if it provides you some sort of value, you have a proper plan on how to utilize it and you can absorb the costs of owning that property. Mark Malan, one of the real estate investors in our network, once mentioned that “we are now in a market in which you need at least 50% downpayment for the property to cash flow positive and for the deal to make sense”.

There’s significantly less buyer competition and bidding wars in today’s market compared to the last couple of years. Until early 2022, property values were forced higher and higher due to high buyer demand caused by historically-low interest rates. Not only did investors have more competition, but they also experienced bidding wars with other real estate investors who had more cash and were willing to pay more than anyone else. Because of this, many of you most likely missed out on owning a multifamily property.

Buyers have a better advantage in today’s market. The biggest opportunity and positive reason to purchase a property today is the fact that there’s significantly less buyer competition and a smaller likelihood of a bidding war with other investors. Since there’s less demand for the potentially increased supply of properties in the market, buyers have the advantage of offering a price that is less than the listed price of the property. If real estate investors believe that prices are going to decrease by 10% later in 2023, then it’s possible to offer 10% less now on any property they’re looking to buy.

Along with the ability to negotiate a lower price, buyers are also able to ask for a lot more concessions such as repairs, and having the seller pay for a portion of closing costs. This was never a possibility before 2022 because investors typically had to buy a property “as is”, so it’s extremely important that you work with an expert multifamily real estate professional who specializes in negotiating in today’s market.

No matter what the market is, there will always be a demand for housing in California. The housing crisis in California isn’t going to just vanish in the next few decades, and people will always need a place to live within the state. This is the biggest driver that’s keeping property values high. So if you have the ability to own a property in California, a product that’s low in supply but high in demand, you’re going to put yourself in a position to win as a real estate investor.

Looking to find the right financing options for your next purchase or refinance? Our team at Sage Trust Mortgage is here to help!

Financing a Commercial Property in 2023 (5+ Units)

When it comes to financing a commercial property that has 5 or more units, it is considered as commercial financing which is available to more experienced investors. Typically, lenders ask for a minimum of 30% downpayment for commercial loans but that landscape of financing has changed as well. In order to finance a property with 5 or more units today, lenders are now requiring buyers to have between a 50-70% downpayment ready and available.

This requirement eliminates a substantial amount of real estate investors in this space because most investors are not used to putting a 70% down payment and only borrowing 30% to finance a property. However, this does not mean that there are no investors buying commercial properties today.

Investor Mindset Today: We’ll hold on to our properties as long as we don’t have a concrete reason to sell them. We’re still looking for good deals, but we won’t take action unless there’s a deal that we absolutely believe in.

The real buyers still in the market for commercial properties are experienced buyers who still believe in real estate as an investment no matter how the real estate market behaves. These types of buyers are still searching for the right opportunities to add to their portfolios, submitting offers for properties, and are willing to accept higher interest rates, but they are definitely negotiating for pricing adjustments like any buyer in today’s market.

When looking to buy commercial properties, don’t worry too much about the higher interest rates today because you always have the option to refinance your mortgage loan when interest rates inevitably adjust within the next 24-36 months.

Today is still a good time to buy a property if:

- the location is right,

- the property is in an area that you know, like, and trust,

- you know it’s a good deal, and

- you’re buying it below what the seller believes it’s worth.

How to Minimize the Risk of Real Estate Investing in Today’s Market

Investor Mindset Today: More than ever, it’s important to know the market you’re looking to buy into if you want to know whether a property is a good deal or not.

It’s difficult for someone to know every market. Don’t look everywhere for a good deal. Look for a property in a market that you are familiar with and never invest in a market that you have not thoroughly researched. Learn what properties sell for and the important metrics that every investor uses to analyze any deal.

What is a good deal in today’s market?

To find a good deal in today’s market, you need to find a motivated seller. This is the type of seller who definitely wants to sell their property, no matter what the circumstance. In most cases, here are the reasons someone might be a motivated seller:

- They recently inherited the property and need to sell it.

- They are tired of being landlords and dealing with problem tenants.

- The property needs a lot of work that they’re not willing to put effort into.

- They have citations from the city for whatever reason.

- The property is owned by multiple owners and one of them has a life-changing event that forces them to sell it.

These are situations in which someone is motivated to sell their property, no matter what condition the real estate market is in. This is where you’re going to have a better chance of negotiating a better price as a buyer.

Other than motivated sellers, the rest of the sellers on the market are just there to “test the market” with their properties. They want the price that they believe the property is worth and they won’t listen to any offers below that price. If they don’t get the price that they want, then they can simply just take the property off the market. Most property owners today have owned their properties for years and have been receiving cash flow from them, so the average seller on the market today is not desperate to sell their property because they have nothing to lose if their property does not sell at their asking price. So don’t waste your time dealing with someone who isn’t absolutely desperate to sell their property.

Purchase with the Intention of Owning Long-Term

At the end of the day, it’s all about your goals and intentions regarding what you want to do with the property. The financial aspect of any deal usually comes second to your intention. However, if you purchase a property with the intention of keeping it for the long term, you’re not going to lose money on your investment. Because of the natural value appreciation of properties in growing markets, any deal today is going to be considered a good deal in 10 years. If you’re in California, you can close your eyes and pick any property to buy because in 10 years, you know it’s guaranteed going to be a good deal.

The Mindset Real Estate Investors Need to Have in Today’s Market

It’s not about timing the market, but it’s all about time in the market. Before early 2022, many real estate investors refused to buy a property and sat on the sidelines during a period in which interest rates were historically low and prices were skyrocketing because of excessive buyer competition. Today, those same people still refuse to buy a property because interest rates are still “too high”. While those investors have refused to get into the real estate game, others who have already invested in the real estate market have already been building their wealth and making tremendous returns on their investments.

It’s never a bad time to buy, especially in California. Experienced investors are still in the market looking for properties to buy, so why shouldn’t you? So align yourself with the right real estate expert and learn from what these experienced investors are telling us.